From 40% to 99.9% Event Match Quality in 4 weeks

How we fixed broken Meta tracking for an e-commerce client, and what it meant for their campaign performance.

4 weeks

Implementation time

60%

ICAC reduction

The problem

Half their conversion data was invisible to Meta

This online retail client was spending $55K/month on Meta ads—but their pixel was only capturing 40-50% of conversion events.

The cause? Browser restrictions (Safari ITP), ad blockers, and privacy regulations were blocking client-side tracking. Meta's algorithm was optimising campaigns with half the data it needed.

The symptoms were clear: unreliable attribution, campaigns that couldn't scale past without efficiency collapse, and an iCAC of $102 that should have been much lower.

The worst part? They didn't know it was happening. From the outside, tracking looked "fine."

The transformation

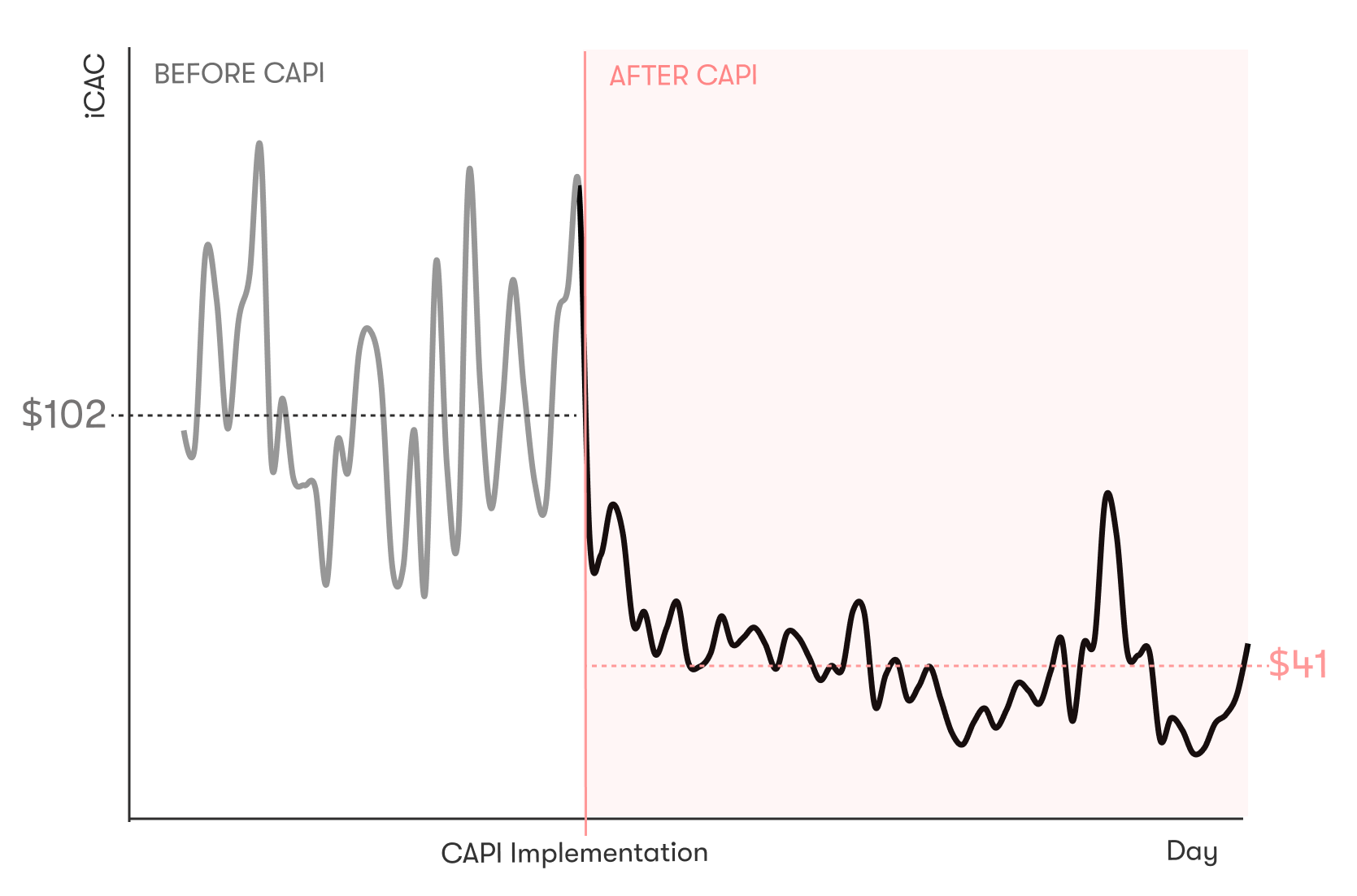

Before vs. after CAPI implementation

Our approach

4 week implementation via GTM server-side

-

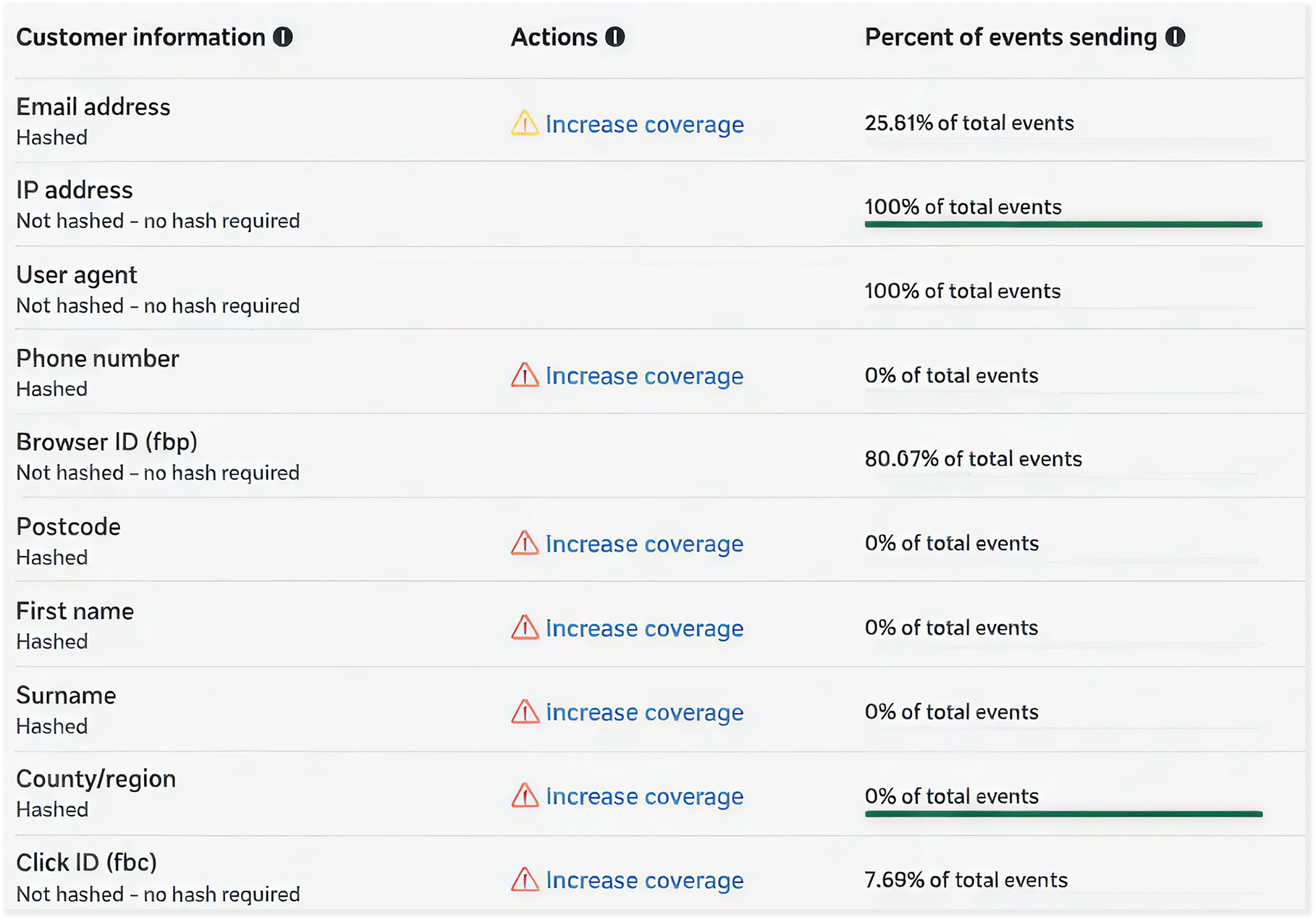

Full tracking audit revealing 40-50% event match quality.

Gap analysis across 4 key conversion events (Purchase, Add to Cart, Initiate Checkout, View Content).

Implementation roadmap developed.

-

GTM Server-Side container deployed and tested.

Server-side infrastructure configured to support CAPI data transmission.

-

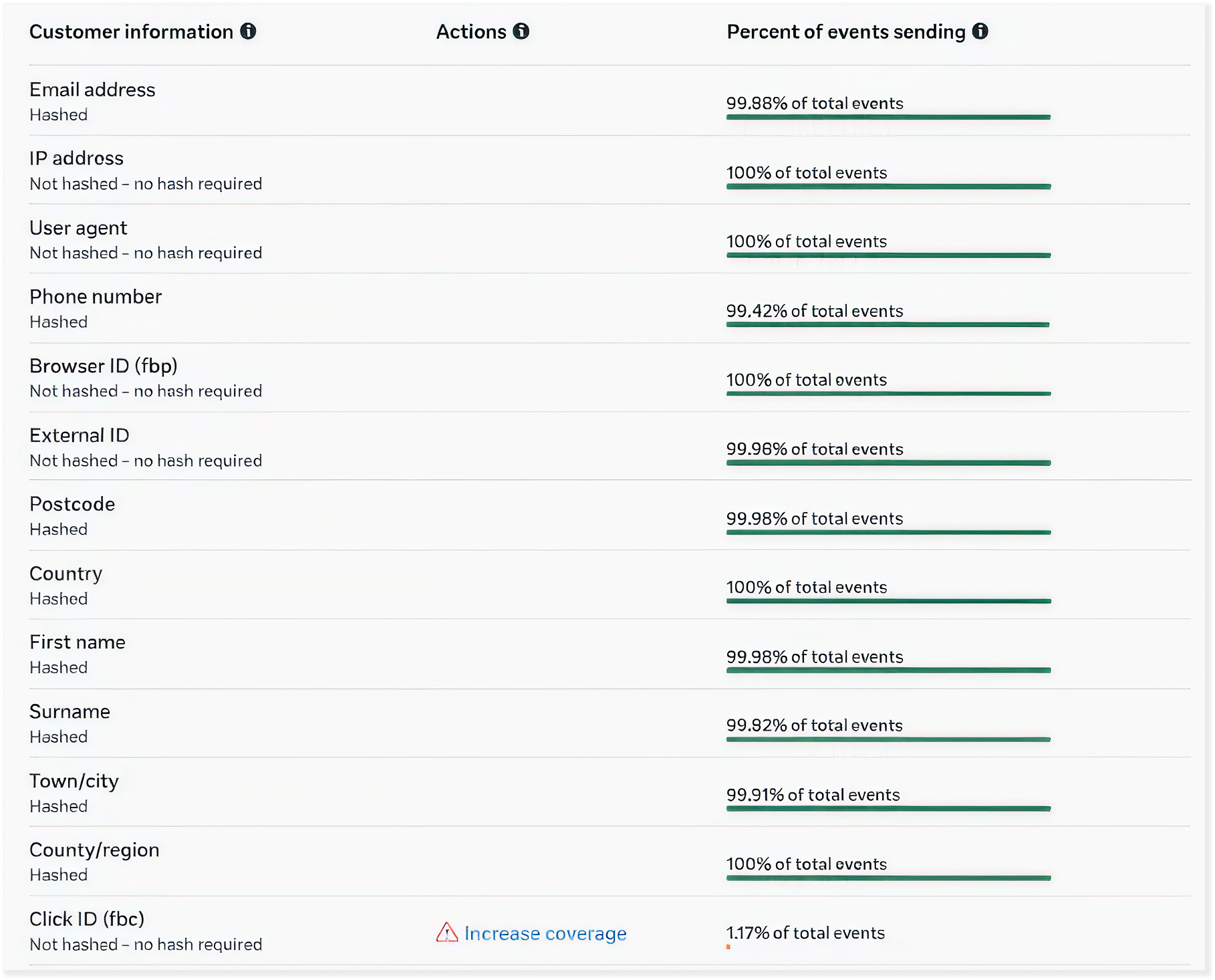

Facebook CAPI tag installed. All 4 conversion events mapped. Deduplication configured via event_id parameter to prevent double-counting between pixel and server. Privacy compliance integrated.

-

Event match quality verified at 99.9% in Meta Events Manager. Deduplication confirmed working correctly. Full documentation delivered and team trained on ongoing monitoring.

💡 Why this matters

Industry average for comparable CAPI implementations is 6-8 weeks. We completed this in 4 weeks using a standardised deployment framework.

The results

Complete data visibility + improved efficiency

| METRIC | BEFORE CAPI | AFTER CAPI | CHANGE |

|---|---|---|---|

| Event match quality | 40 - 50% | 99.9% | +50 pp |

| iCAC (Incremental Customer Acquisition Cost) | $102 | $41 | 60% |

| Implementation time | - | 7 days | vs. 4 - 6 week avg |

| Conversion events tracked | Partial | 4 events, 100% coverage | Complete |

The financial impact

Within a month of CAPI going live, iCAC dropped from averaging $102 to $41, a 60% reduction.

The improved attribution also revealed which campaigns were actually driving results. With accurate data, the client could confidently reallocate budget from underperformers to top performers.

Most importantly: with reliable tracking in place, the client could finally scale spend without watching efficiency collapse.

Is this you?

How to Know If Your Tracking Is Broken

If your Meta campaigns plateau when you scale spend, your attribution reports don't match actual revenue, or scaling tanks your ROAS, the problem likely isn't your creative or audience targeting.

It's your data.

Pixel-only tracking in 2026 captures 40-60% of conversions at best. CAPI closes that gap. It's not a technical nice-to-have — it's the infrastructure that makes optimisation possible.

🔍 The Diagnostic Question

Check your Event Match Quality in Meta Events Manager. If any conversion event is below 90%, you're leaving performance on the table.

Want results like this?

We've deployed CAPI for e-commerce brands across Australia.

💰 Investment

One-off, fixed price

🔓 No Lock-In

No long-term contracts. If we don't hit agreed targets within 90 days, you walk with no penalty.

We’ll pull your Event Match Quality scores and show you exactly what you’re missing.